Is Dropshipping Legal in 2025? Rules You Must Know

I'm looking for...

Is dropshipping legal in 2025? Yes—but it comes with serious rules you need to follow.

In this guide, I’ll walk you through what’s legal, what can get your store banned, and how to make sure your dropshipping business is 100% compliant—from taxes and licenses to age limits and platform restrictions. If you’re planning to start or scale this year, this is the legal playbook you can’t skip.

Create Your Online Store in just 5 Minutes – For Free

Pick your niche, our AI builds your store, add 10 winning products and we teach you how start selling today. Start picking your niche

Is Dropshipping Legal- Key Takeaways

Dropshipping is legal in the US, Canada, UK, EU, and more — but each country has its own tax and legal requirements.

Never sell unauthorized products. Avoid brand names like Nike or Apple unless you have permission or reseller rights.

Register your business (LLC or sole proprietorship) to protect yourself legally and access trusted payment gateways.

Open verified payment accounts with PayPal, Stripe, or Shopify Payments to prevent account limitations or freezes.

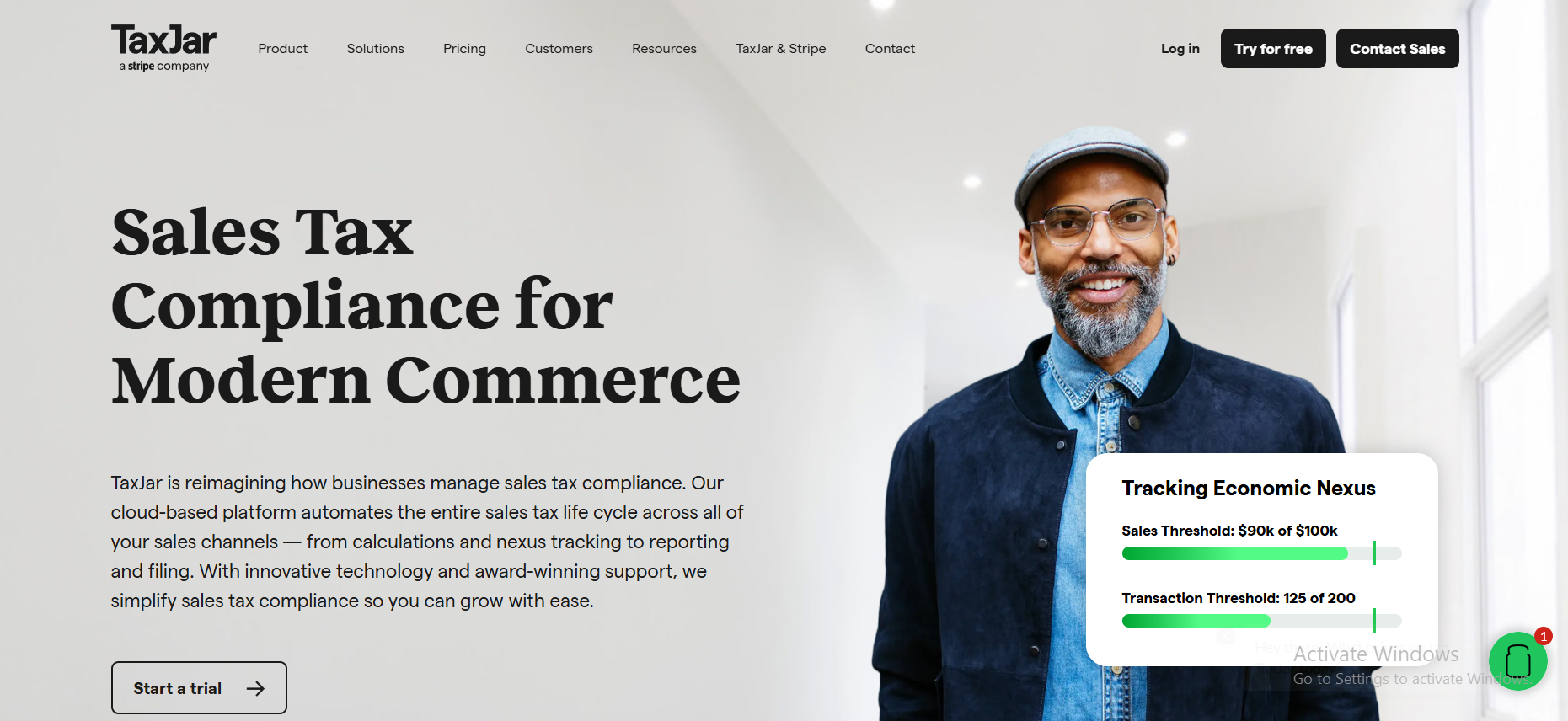

Handle your taxes properly. Tools like TaxJar, Quaderno, or a local accountant can help you stay compliant.

Add legal pages like Privacy Policy, Terms & Conditions, and Refund Policy to build trust and run compliant ads.

Under 18? You’ll need a parent or guardian to register accounts and manage legal documents on your behalf.

Use verified suppliers only. Order samples and check supplier legitimacy using tools like Spocket, Dropshipping.com, or HyperSKU.

Don’t lie in your ads. Misleading claims can get you banned on TikTok, Facebook, and Shopify. Be honest with descriptions.

Use secure platforms like DSers, TradeSafe, or blockchain-based verifications for high-ticket or international orders.

Is Dropshipping Legal in 2025?

Yes, dropshipping is legal in 2025—I run a compliant store myself. What matters is how you do it. You need to follow local business laws, pay taxes, avoid selling copyrighted or restricted products, and work with trustworthy suppliers.

Stick to the rules, and you’re building a real business—not a scam.

Nearly every retail giant worldwide uses dropshipping as a method to fulfill customer orders. Although, there are dropshipping rules we have to all follow.

If we don’t follow these rules, we can put our dropshipping business into serious trouble.

👉 Learn about Dropshipping: Is It A Real Business or a Get-Rich-Quick Scheme?

Legal Issues to Watch Out For When Starting a Dropshipping Business in 2025

If you’re diving into dropshipping in 2025, don’t skip over the legal stuff. Trust me—it’s not the most exciting part, but ignoring it can seriously hurt your business.

I’ve seen people lose thousands just because they didn’t know the rules.

So let’s break down the three most important legal concerns you should handle right from the start, and I’ll share some tips from my own experience to help you stay compliant.

1. Know If You’re Allowed to Sell the Product from Your Supplier

This one’s huge—just because a supplier is offering a product doesn’t mean they’re legally allowed to dropship it to you.

I once tried listing a trending gadget from a Chinese supplier. Looked legit. Good price. Nice margins. But it turns out they didn’t actually have the license to sell it internationally. The product was pulled from my store within a week after I received a legal notice. Not fun.

💡 My Advice:

- Always ask your supplier: “Do you have the right license or certificates to resell this product internationally?”

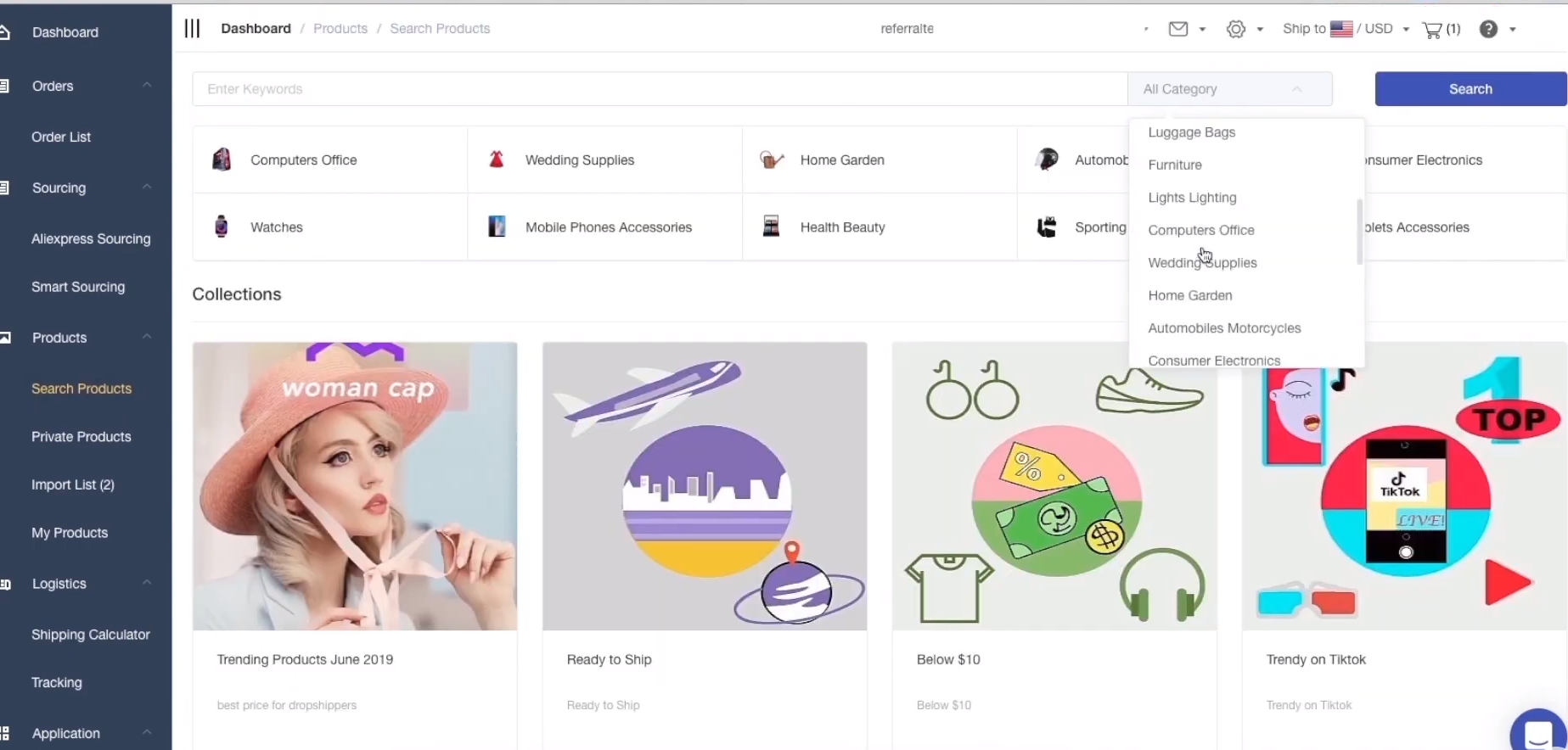

- Stick with verified suppliers on platforms like AliExpress, CJdropshipping, or use platforms like Spocket or DSers that vet their partners.

- Avoid products with brand names or logos unless you’ve been given written permission or a reselling license.

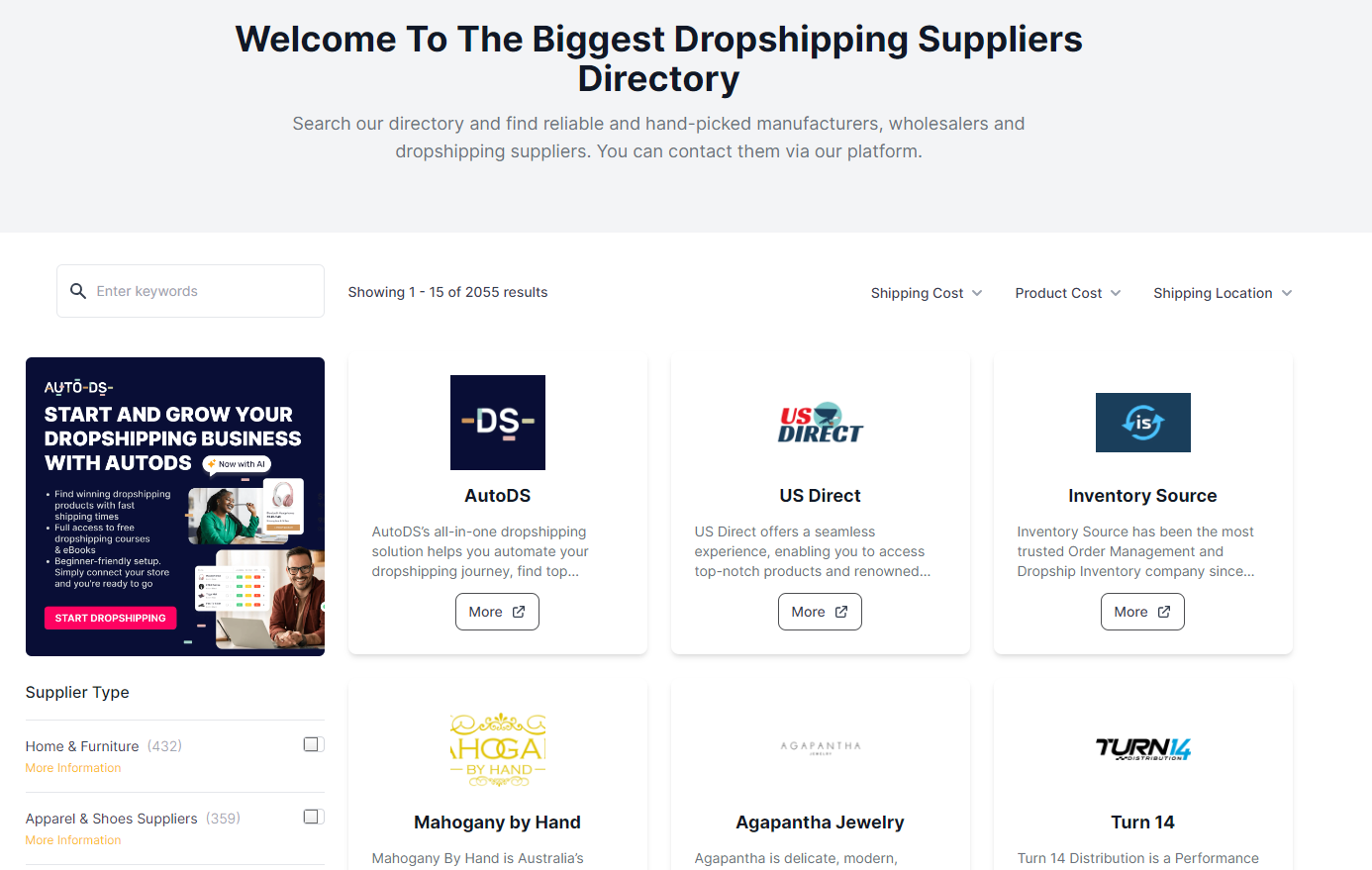

I personally rely on Dropshipping.com’s supplier directory, since they only offer legit suppliers, whether from China, the USA, Australia, or the EU suppliers.

2. Don’t Fall Into the Trap of False Advertising

I get it—you want your product pages and ads to stand out. But don’t stretch the truth, especially on platforms like TikTok or Facebook.

I ran a TikTok ad saying a skincare product would “instantly erase wrinkles.” Guess what? A customer called me out with a bad review, and Facebook flagged the ad. My ad account was nearly banned.

💡 My Advice:

- Use accurate product descriptions. If it takes 2 weeks to work, don’t say “instant results.”

- Include real user photos or reviews if you have them.

- Test the product yourself or get sample units—then describe it honestly based on what you see.

3. Handle Taxes the Right Way (Trust Me on This One)

Out of everything, taxes are the part most new dropshippers overlook. But once the money starts coming in, the taxman will come knocking.

I made a few thousand in my first couple of months and didn’t think much of it. But when tax season came around, I got hit with unexpected fees because I hadn’t registered my business properly or collected sales tax in some states.

💡 My Advice:

- Register your business early—whether it’s an LLC or sole proprietorship.

- Use tools like TaxJar or Quaderno to manage sales tax collection.

- Consider using services like Duet or Bench—they can handle bookkeeping, Shopify integration, and tax filing automatically.

- Talk to a local accountant, especially if you’re selling internationally. It’s worth every penny.

All Legal Requirements For Starting a Dropshipping Business in 2025 (Must-Know Facts)

Let me say it loud and clear: dropshipping is a real business, and that means real legal requirements. If you ignore them, you’re setting yourself up for trouble — from frozen payment accounts to tax penalties and even lawsuits if you’re selling restricted or trademarked items.

I’ve been through the startup phase, and I’ve helped others set up their stores legally. So here’s the complete list of legal requirements you need to follow — especially if you’re under 18, unsure about taxes, or using international suppliers.

🏛️ Business Registration and Legal Setup

If you’re serious about growing your dropshipping store in 2025, you need to register your business. Otherwise, you can’t legally handle taxes, apply for payment processors, or open a business bank account.

✅ Options:

- Sole Proprietorship: Easiest to start, but you’re personally liable for any debts or lawsuits.

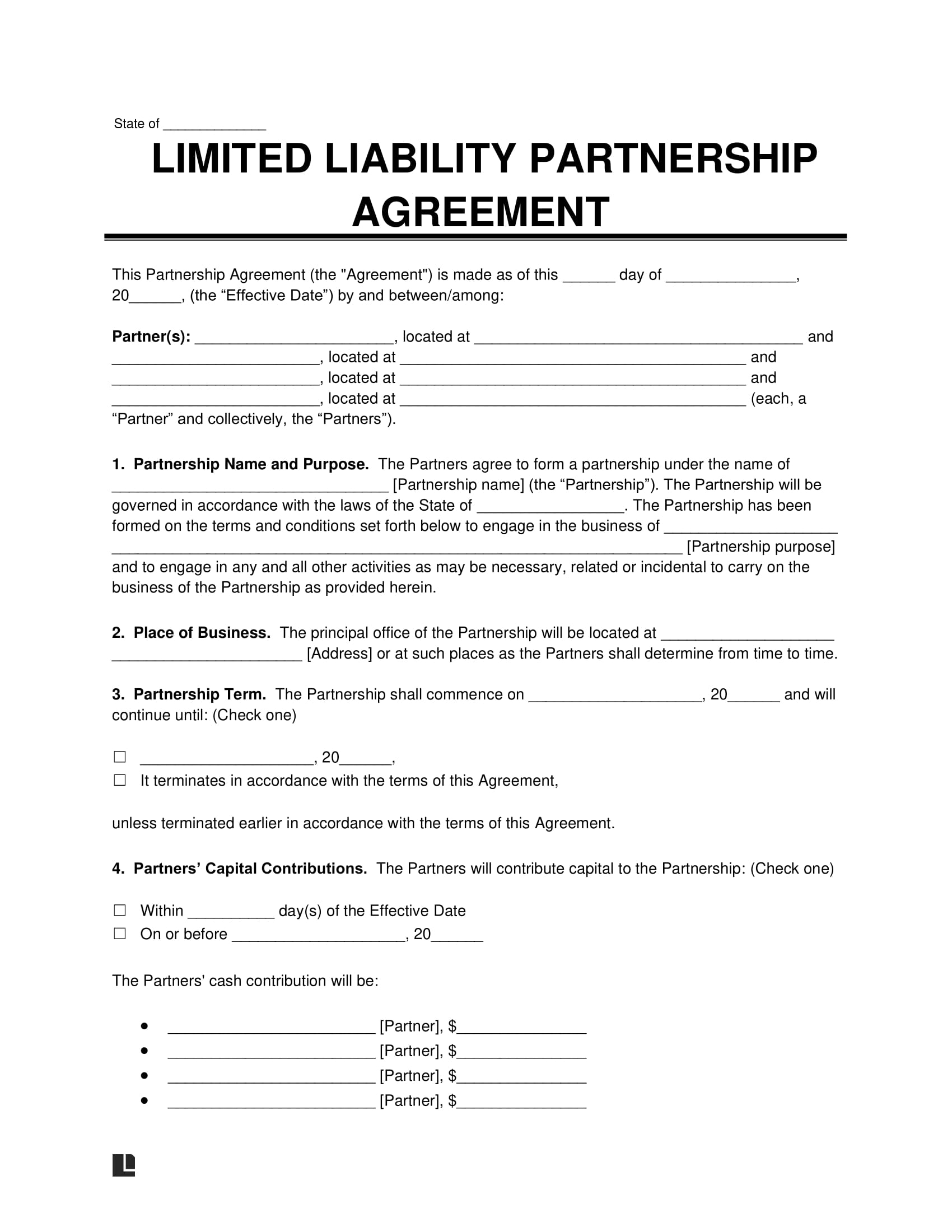

- LLC (Limited Liability Company): My top pick. Offers personal liability protection, looks more professional, and is easy to register in most countries.

- Corporation: Ideal for scaling big, but not necessary when starting out.

💡 My Tip:

Start with an LLC, especially if you’re in the U.S. You can register online through platforms like Doola, ZenBusiness, or even directly with your state. Expect to pay $50–$200, depending on your state or country.

💳 Legal Use of Payment Gateways and Bank Accounts

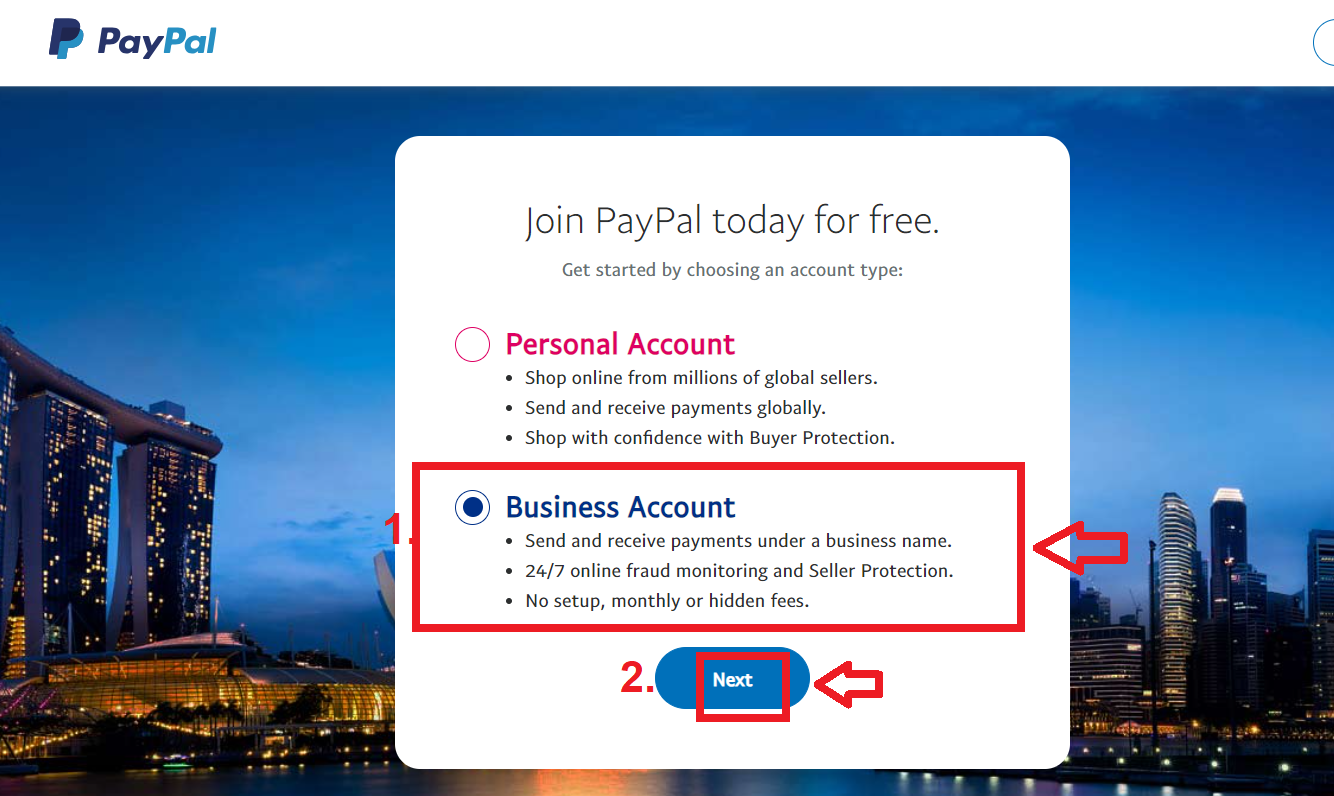

To accept customer payments, you’ll need verified business accounts with Stripe, PayPal, or Shopify Payments. Each of these platforms will ask for:

- Government-issued ID

- Proof of address

- Business registration details

- Business bank account (sometimes optional early on)

I once helped someone who used their personal PayPal for business. After a few large orders came through, PayPal froze the account and requested business documentation, which they didn’t have. They lost access to over $2,000 for weeks.

✅ Best Practices:

- Create business accounts with PayPal/Stripe under your legal business name

- Open a separate bank account for business funds (many online banks offer this for free)

- Use Shopify Payments if available in your country — they make things easier

🧾 Taxes: Sales Tax, Income Tax, and International Rules

Taxes are where most beginner dropshippers get confused, and it’s easy to make mistakes.

✔️ Sales Tax (U.S. Specific):

- If you’re based in the U.S., you must collect sales tax from customers in any state where you have “nexus” (a business presence).

- Shopify and platforms like TaxJar can automatically calculate and collect the correct tax rates.

✔️ Income Tax (Global):

- No matter where you are, you must report your dropshipping income on your tax return.

- This includes profits, expenses, and product costs.

In my early days, I didn’t know I had to collect sales tax from Florida customers. During my first tax season, I got a notice from the Florida Department of Revenue. Thankfully, I caught up using TaxJar and registered for a sales tax permit, but it was a headache.

💡 What To Do:

- Register for a sales tax permit in your home state (U.S.) or VAT if in Europe

- Use tools like:

- TaxJar or Quaderno – for automatic tax calculations

- Duet or Bench – for bookkeeping and tax filing

- Hire a local accountant when in doubt, especially if you’re selling internationally

🔐 Privacy Policy, Terms, and Legal Pages

When you collect emails, addresses, or payment info, you need to be transparent and compliant with privacy laws, especially if you’re selling to the EU or California.

✅ Pages You MUST Add:

- Privacy Policy

- Terms and Conditions

- Refund Policy

- Shipping Policy

Shopify has free templates for these, or you can generate them using tools like Termly.io or Shopify’s legal page builder.

💡 Tips:

- If you advertise on Facebook or Google, they’ll check for these pages before approving your ads.

- Add these to your footer navigation so they’re easy to find.

🚫 Product Legality and Supplier Compliance

This one’s often overlooked but very important: make sure the products you’re selling are legal to resell and not violating any trademarks or patents.

A friend of mine listed a phone case with a Marvel logo — it was taken down in 48 hours, and their store received a DMCA takedown from Disney’s lawyers. No warning.

🔍 What to Watch Out For:

- Products with brand logos (like Nike, Apple, Marvel)

- Health-related items that make medical claims

- Items with restricted certifications, like FDA approval

✅ What To Do:

- Ask your supplier for resale rights or proof of licensing

- Avoid anything that smells like a replica or knock-off

- Use trusted directories like Spocket, Syncee, or SaleHoo, which vet their suppliers

Can You Legally Dropship If You’re Under 18?

This is a hot topic, and I hear the question a lot: “I’m 15 or 16 — can I legally start a dropshipping store?”

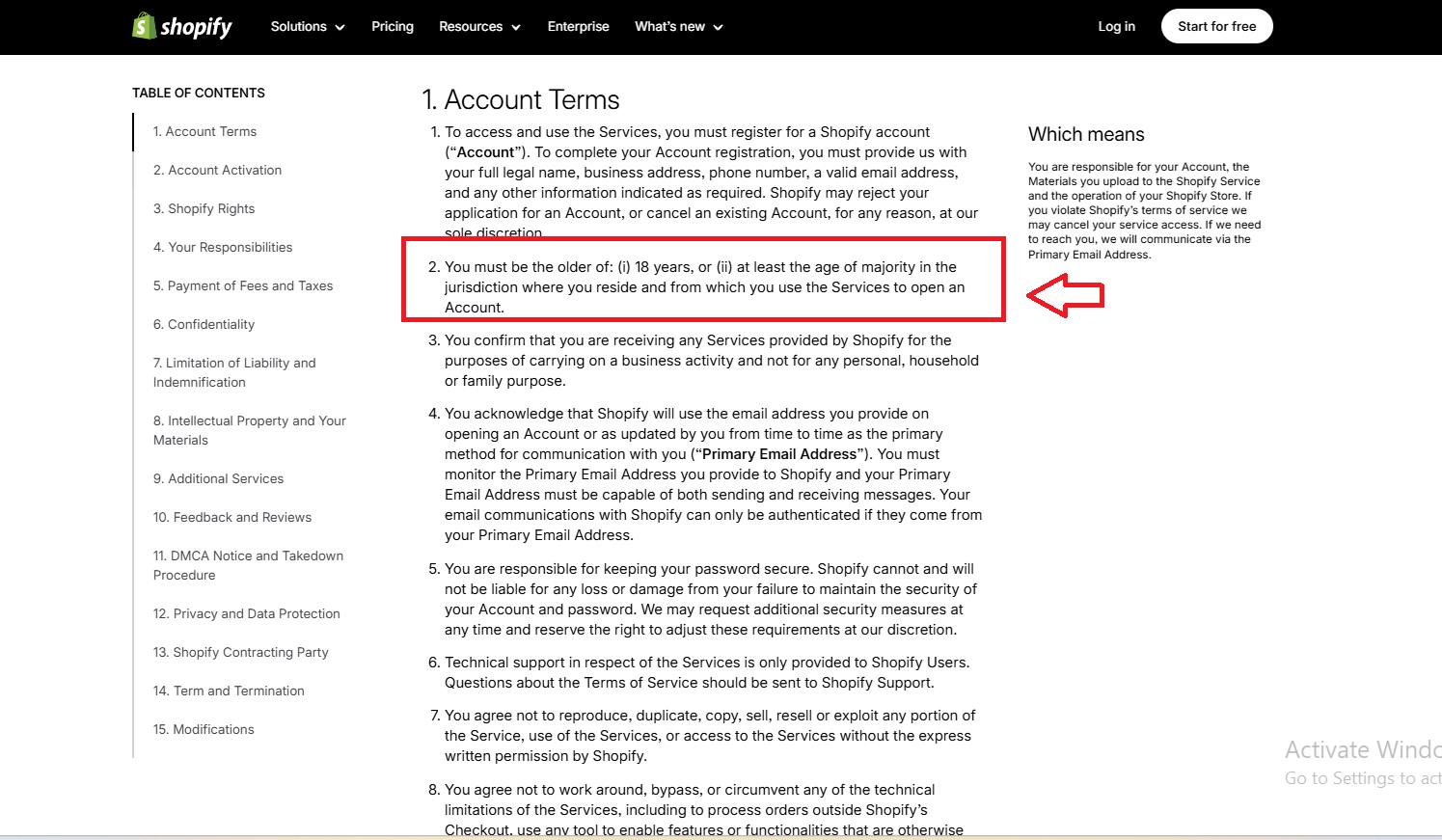

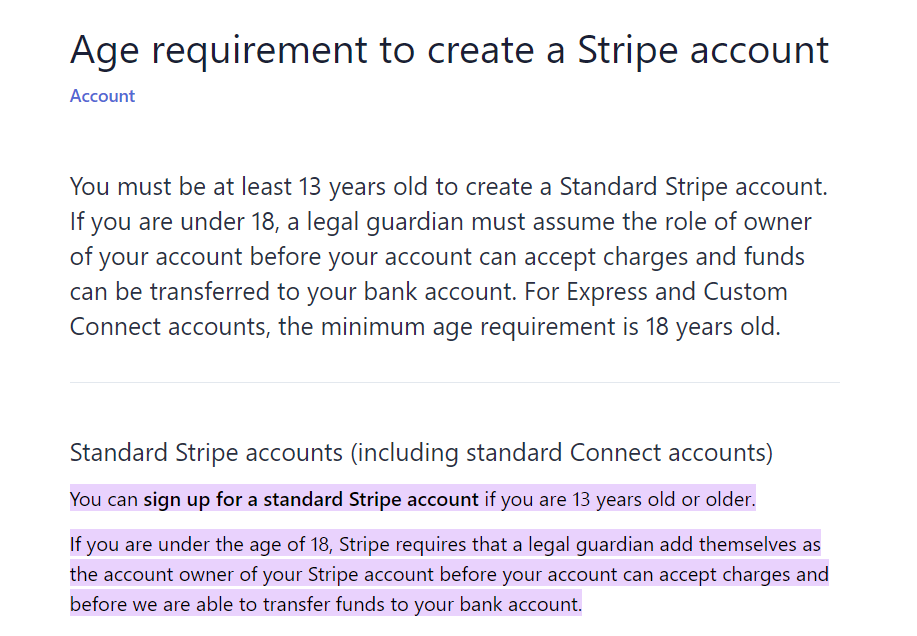

Here’s the truth: Most platforms and payment processors require you to be at least 18 years old to create an account or enter into a contract. That includes:

- Shopify – Requires the account holder to be 18+

- AliExpress – Their terms state users must be 18+

- Stripe and PayPal – Need a legal ID and only approve accounts for adults

One teen entrepreneur I knew launched a store using Shopify and Stripe, but since his name didn’t match his ID and he was under 18, his Stripe account was frozen, and the money was stuck until a parent stepped in and took over the account.

✅ What To Do If You’re Underage:

If you’re under 18, the easiest and safest solution is:

- Ask your parent or guardian to register everything under their name – business, payment processors, and even the Shopify account

- You’ll run the store, but they’ll be the official owner (at least until you turn 18)

- Be honest and transparent — this helps avoid getting banned or frozen

| Age Range | Allowed Activities | Restrictions | How to Dropship | Recommended Tools & Tips |

|---|---|---|---|---|

| 13–15 | Learn product research, design with Canva, run mock stores, manage social media accounts | Cannot legally sign contracts or open accounts on Shopify, PayPal, etc. | Use a parent or guardian’s account for registration; focus on branding, content, and social media marketing | Use Canva, TikTok, Google Trends; follow YouTube tutorials & test ad ideas |

| 16–17 | Run marketing, create TikToks, operate store (with adult managing payment accounts) | Need adult for account creation and financial setup | Have a parent register your Shopify/Stripe account; you manage product research, design, and ad content | Use Printify + Etsy, Adserea, Ubersuggest; focus on viral trends and organic traffic |

| 18+ | Launch and fully manage a legal dropshipping business independently | No restrictions – you can register businesses, payment processors, and platforms | Set up your LLC, choose a niche, build your store, connect Stripe, and run ads directly | Use Shopify, Klaviyo, Printful, ReConvert; automate and scale efficiently |

Once you’re 18, you can transfer ownership to yourself and apply for your own business ID.

Dropshipping Scams To Avoid & How I Built a Legal, Legit Business

I’ve been through the ups and downs of dropshipping. I’ve wasted money, got tricked by fake suppliers, and even chased refunds from shady platforms.

So in this guide, I’m sharing everything I wish I knew when I started. Here’s how I avoid scams today — and how you can build a legally compliant dropshipping business that actually lasts.

1. Start With This: Order Samples & Test Everything Yourself

I don’t trust any supplier until I’ve ordered their products myself — period. Either I request samples directly, or I place a few small orders under different names to see how consistent they are with packaging, shipping, and quality.

When that’s not enough, I hire a third-party quality control agent (especially for high-ticket items). It’s saved me from sending junk to customers more than once.

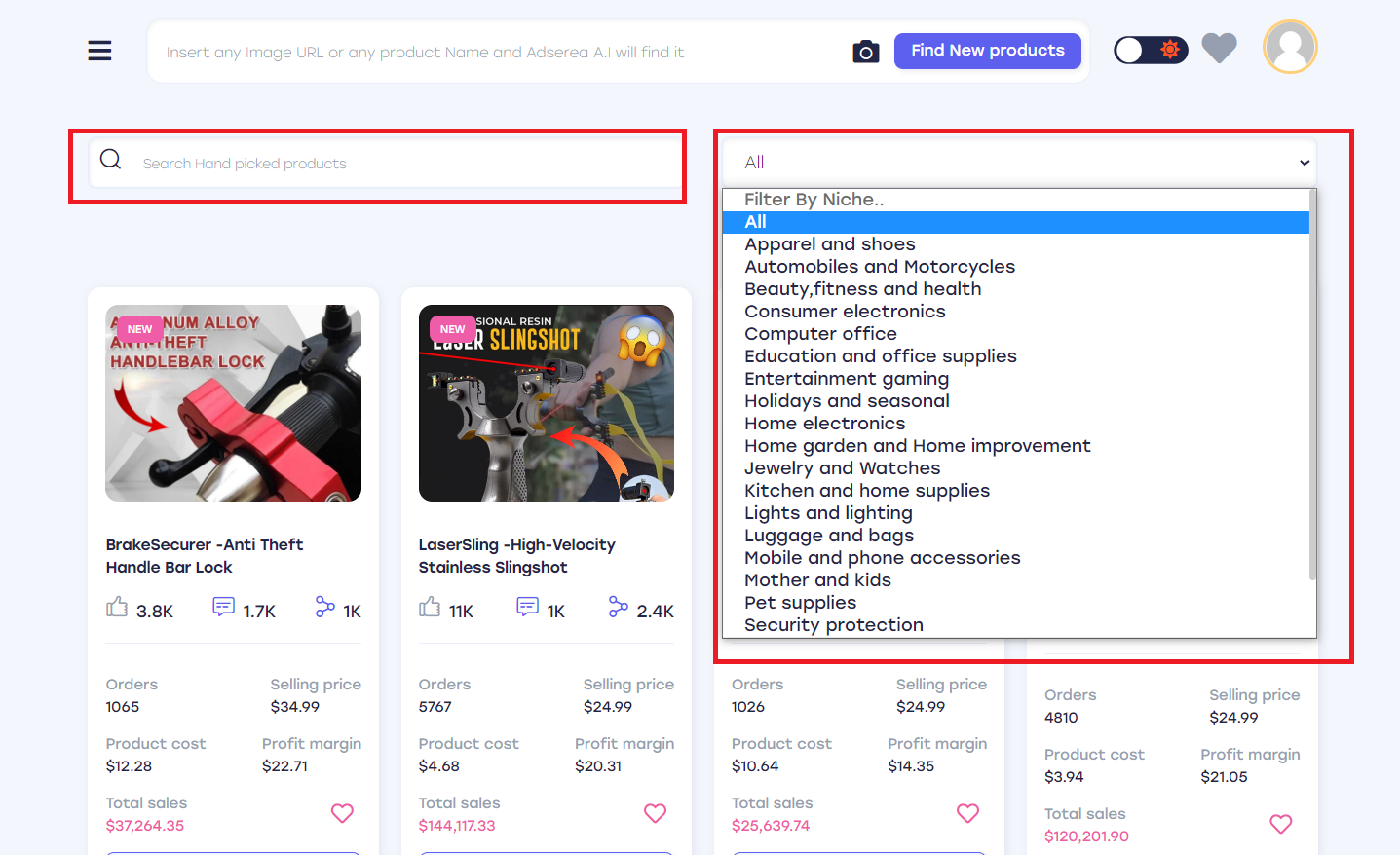

And before I even shortlist suppliers, I use tools like Adserea to research winning products that are trending and backed by reliable vendors. Filtering by delivery time, product rating, and supplier feedback gives me a massive head start.

2. Fake Suppliers Look Real in 2025 — Here’s How I Spot Them

In 2025, it’s wild how legit some fake supplier websites can look. AI-generated reviews, chatbot support, even fake testimonials — it’s all smoke and mirrors.

So I run reverse image searches on product photos, look up the domain with WHOIS Lookup, and check if they have real employees on LinkedIn. If anything feels off, I walk away.

Also, I never skip using the Dropshipping.com Supplier Directory — it’s been my go-to for vetted suppliers, especially when I want to avoid the AliExpress roulette. It’s free and lists over 2,000 options I can dig into.

3. Payment Security Is Non-Negotiable

Early on, I learned the hard way: never pay suppliers via wire transfers or sketchy offline methods. Stick to platforms with escrow protection like AliExpress or Alibaba.

When I work outside those ecosystems, I use verified payment processors like:

- PayPal

- Shopify Payments

- Stripe

- Google Pay

- Amazon Pay

And yes — always read the fine print. I’ve seen cases where even PayPal bans dropshipping accounts.

That’s why I wrote a full breakdown on how to use PayPal for dropshipping safely — it’s a must-read before setting up.

4. Don’t Fall for AI-Polished Scams in 2025

Scammers now use AI to build entire supplier brands in minutes — site, product photos, reviews, chatbots, all fake. Just because it looks professional doesn’t mean it’s real.

My tactic? Ask the supplier very specific product questions. Most AI or outsourced reps will dodge or give copy-paste answers. Real suppliers know their catalog. If they hesitate, I move on.

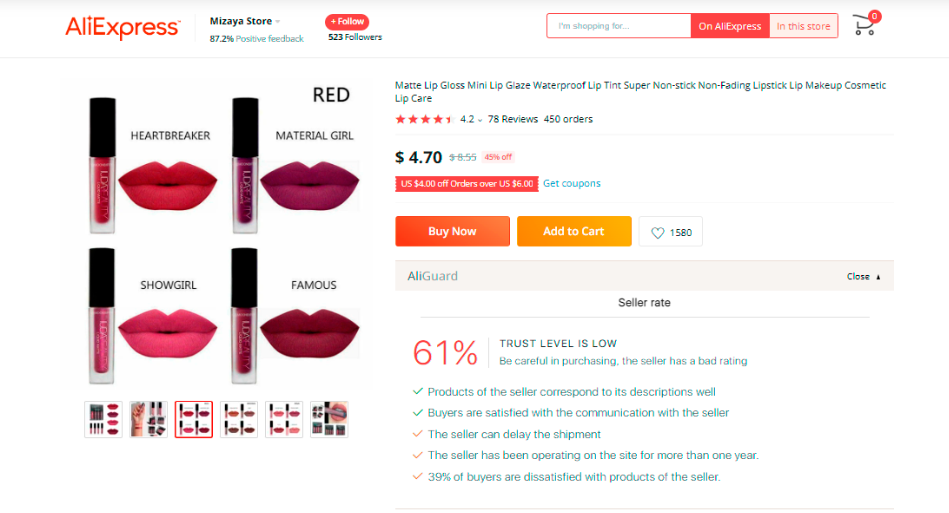

5. Use Smart Tools Like AliGuard or Spocket Shield

In 2025, extensions like AliGuard are a game changer for AliExpress sellers. They show hidden scores based on refund rates, fake tracking, or delayed deliveries — the stuff the platform hides.

DSValidator and Spocket Shield are also solid if you’re working on other platforms. I always check these before adding a supplier to my store.

6. Find Social Proof Outside the Platform

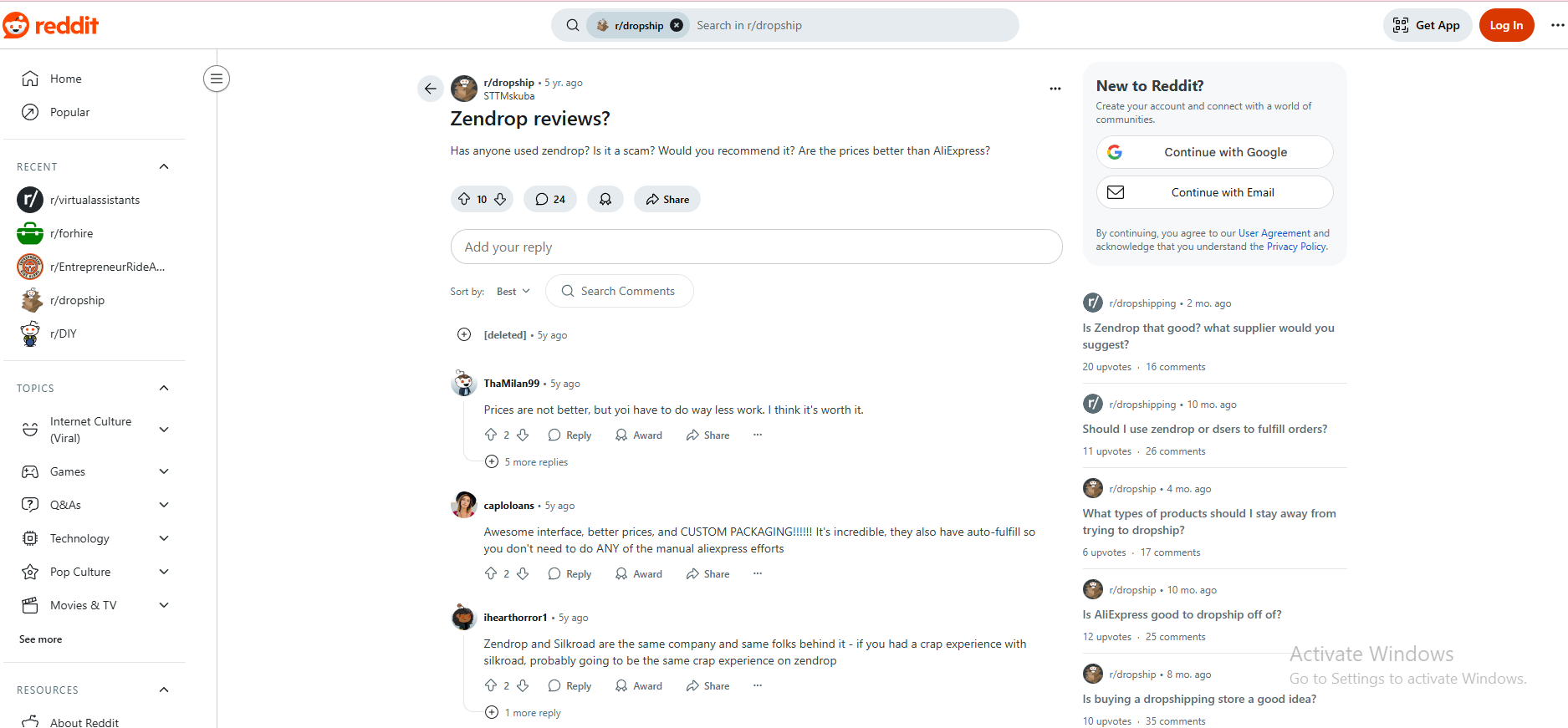

I don’t trust reviews on the supplier’s website or even on marketplaces alone. I dig deeper — Reddit threads, Facebook dropshipping groups, and Discord communities often reveal the truth.

If someone got scammed, it’s usually discussed there first. It’s how I avoided a “too good to be true” supplier last year who vanished with thousands in orders.

7. Blockchain Verification? Yes, It’s a Thing Now

Some platforms, like HyperSKU and TradeSafe, now offer blockchain-based verification for suppliers. That means proof-of-origin, shipping history, and supplier legitimacy are permanently recorded.

I’m using HyperSKU more often now for expensive products — it gives me peace of mind and something real to show customers if they ask about sourcing.

How To Build a Legitimate Dropshipping Business (The Right Way)

| Step | What You Need | Cost Estimate |

|---|---|---|

| Register your LLC/LLP | Doola, ZenBusiness, or Incfile | $50–$300 (varies by state) |

| Apply for EIN | IRS.gov (Online Application) | Free |

| Get Business License | Check local/state business portals | $20–$100 |

| Open Business Bank Account | Novo, Mercury, Relay, or local bank | Free–$25/month |

| Handle Taxes | QuickBooks, Wave, spreadsheet, or CPA | $0–$300/year |

When I first got into dropshipping, I was focused on products, suppliers, and ad creatives — but I overlooked the most important part: legitimizing my business. And let me tell you, once I did, everything felt more professional — from opening payment gateways to building supplier trust.

Here’s exactly how I did it and how you can do the same:

1. Choose the Right Business Structure

For me, going with an LLC (Limited Liability Company) was a no-brainer. Why?

Because it separates your personal assets from your business. If anything goes wrong — like legal trouble, a major refund mess, or supplier disputes — your personal finances are protected. You won’t lose your house over a lost package.

Here’s what you need to do:

- Use a service like Doola, ZenBusiness, or Incfile to set up your LLC online in minutes.

- Pick your state wisely. I used Wyoming because of low fees and privacy perks, but many go with Delaware or their home state.

If you’re starting with a partner, consider an LLP (Limited Liability Partnership) instead — great for shared control and liability protection.

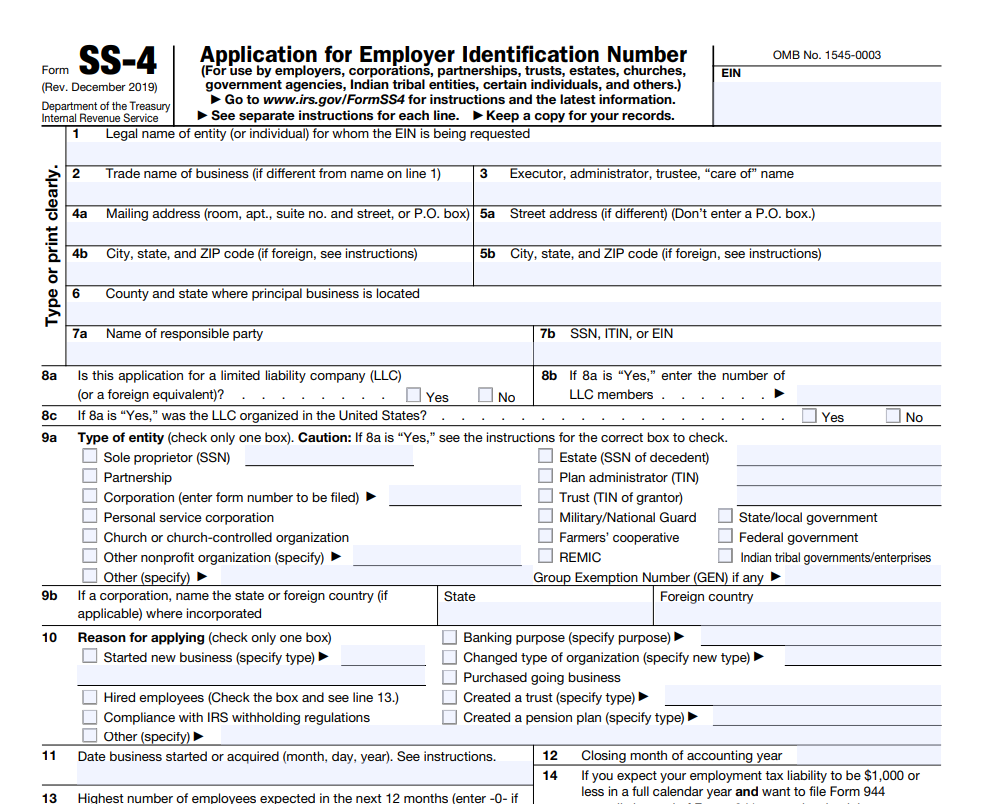

2. Apply for an EIN (Employer Identification Number)

Think of this like your business’s Social Security Number.

You need it to:

- Open a business bank account

- File business taxes

- Apply for wholesale supplier accounts

- Set up Shopify Payments or Stripe

How I did it:

- I went straight to the IRS website and applied online.

- It was completely free, took about 10–15 minutes, and I got my EIN instantly.

Make sure your business name and address match exactly what you registered in your LLC — that saves time down the road with banks or payment processors.

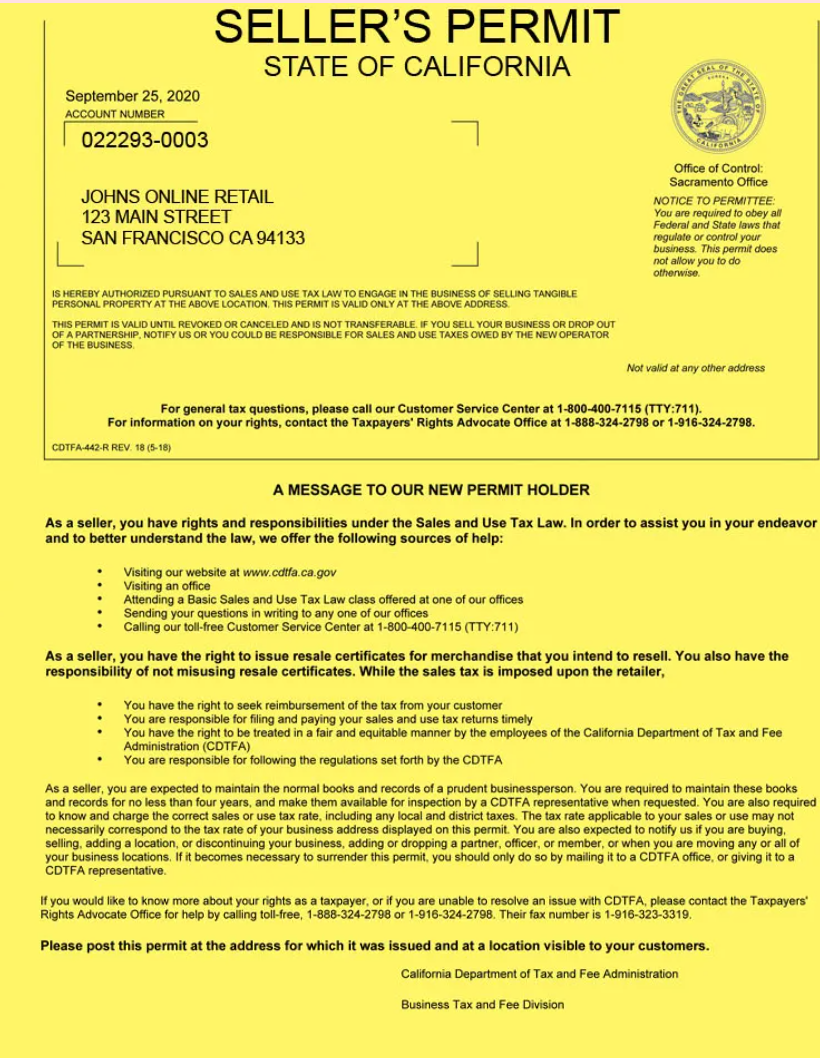

3. Get Your Business License or Seller’s Permit

This is what gives you the green light to operate legally in your city, county, or state. Each place has its own rules, so don’t assume you’re good without checking.

How to do it:

- Go to your state’s Department of Revenue or local city hall website

- Search for “Business License” or “Seller’s Permit”

- Fill out the application, which usually costs around $20–$100, depending on your location

For my dropshipping store, I needed a Seller’s Permit because I was collecting and remitting sales tax. Without it, I wouldn’t be able to buy products tax-free from suppliers, and that cuts into your margins.

4. Set Up a Business Bank Account

This might sound simple, but it changed how I ran my store. I used to mix my business and personal money — big mistake.

Once I got my EIN, I opened a business checking account at my local bank. I also looked into online banks like Novo, Mercury, and Relay — they’re made for eCommerce and have no monthly fees.

Here’s why this matters:

- You get clean bookkeeping for taxes

- Payment processors and Shopify see you as a real business

- You avoid legal headaches by keeping your business finances separate

💬 Pro tip: Pair your bank account with a business credit card — like Brex or Capital On Tap — for cashback on ad spend.

5. Understand & Handle Your Taxes

Taxes used to scare me. But once I set things up properly, they became manageable — and I stopped worrying about unexpected bills.

Here’s what I do now:

- Track everything using QuickBooks or Wave Accounting

- Keep a monthly spreadsheet of income and expenses (I created my own template to stay organized)

- Set aside at least 25–30% of my profits for taxes — especially if you’re making more than $10K/month

- File quarterly estimated taxes if you’re in the U.S. — trust me, it’s better than a huge year-end bill

- I eventually hired a tax professional who understood online businesses. It cost me a few hundred, but saved me thousands.

Is Dropshipping Allowed on Major Platforms?

| Platform | Is Dropshipping Allowed? | Key Rules | Turnaround / Workaround |

|---|---|---|---|

| Etsy | ⚠️ Not Directly Allowed | You must design or customize the product yourself. Third-party fulfillment is allowed but not sourcing mass-produced goods from suppliers like AliExpress. | Use Print-on-Demand (POD) or private label. Customize the design to comply with Etsy’s handmade/vintage policy. |

| Amazon | ✅ Allowed With Restrictions | You must be the seller of record. The product must not ship with third-party invoices or branding. You’re responsible for customer service and returns. | Use Amazon FBA or ensure your supplier ships anonymously. Never use AliExpress-branded packaging. |

| eBay | ✅ Allowed With Conditions | You can dropship if the order is fulfilled from a wholesale supplier. Retail arbitrage (e.g., from Amazon to eBay) is against policy. | Partner with wholesale-friendly suppliers like CJ Dropshipping or AutoDS-integrated vendors. |

| AliExpress | ✅ Allowed & Common | AliExpress itself is a supplier platform. Thousands use it to fulfill dropshipping orders via platforms like Shopify or WooCommerce. | Use apps like DSers or AutoDS for automation. Choose suppliers with ePacket or fast shipping options. |

| Temu | ❌ Not Allowed | Temu prohibits reselling or commercial use of its products. It’s strictly for consumer purchases. | Do **not** use Temu as a supplier. Use it only for product research, then source similar items from Alibaba or a legit wholesaler. |

| Shopify | ✅ Fully Allowed | You fully own your store, so dropshipping is permitted. You are responsible for fulfillment, refunds, and customer satisfaction. | Use integrated apps like DSers, Zendrop, or Spocket. You control the full branding and process. |

| Walmart Marketplace | ⚠️ Allowed With Strict Rules | You must ship in unbranded packaging and be the seller of record. Using Amazon or other retailers as suppliers is not allowed. | Work with vetted wholesale suppliers like GreenDropShip, or use WFS (Walmart Fulfillment Services). |

| Target | ❌ Not Allowed | Target is strictly for consumer shopping. Using it for dropshipping is a violation of terms. | Use Target for product ideas only. Then find a similar product from a B2B dropshipping supplier. |

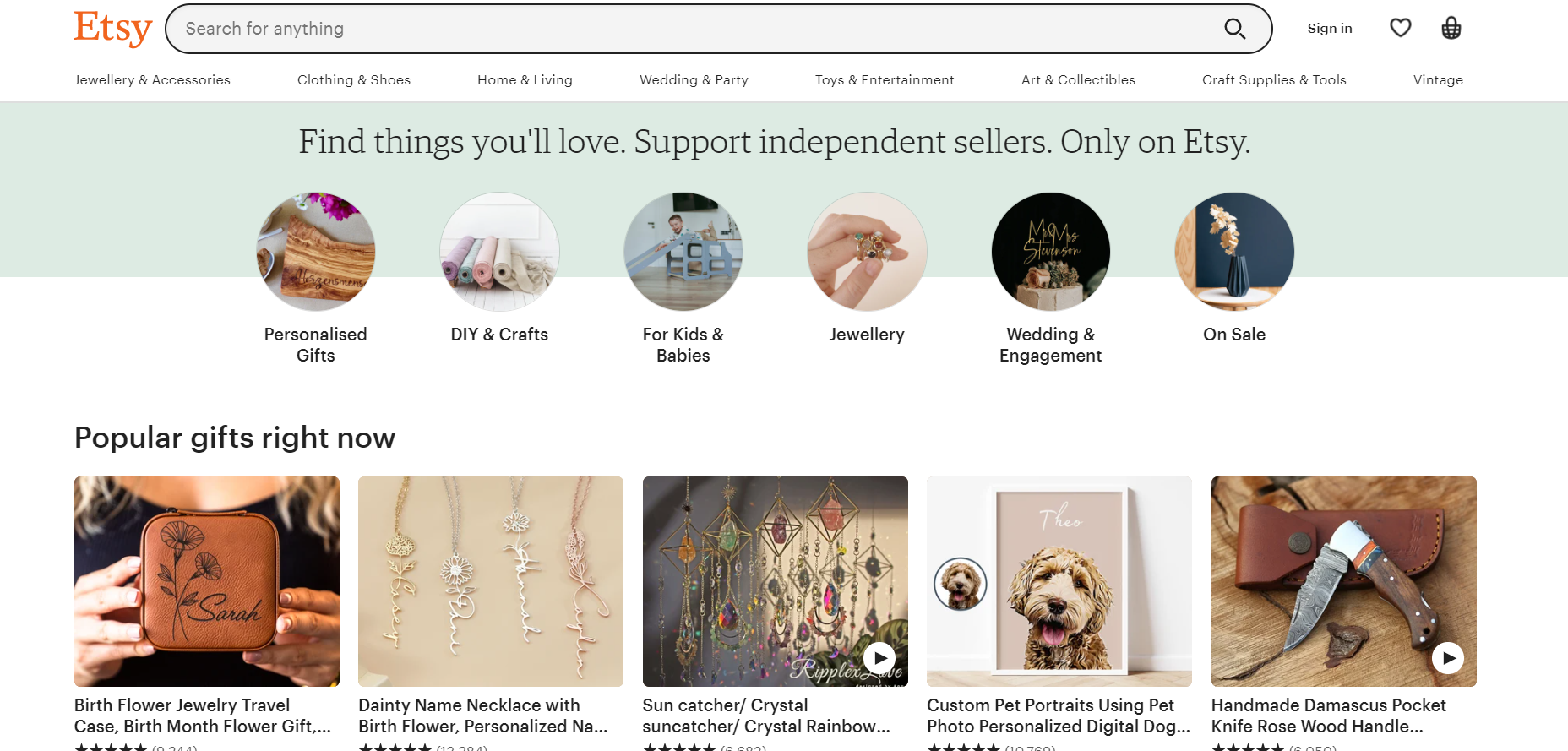

Etsy

Is Dropshipping Allowed?

No – not directly allowed

Platform Policy

Etsy only permits products that are handmade, vintage, or craft supplies. You can’t sell mass-produced items from third-party suppliers like AliExpress.

However, Etsy does allow you to work with a production partner as long as you create or design the product yourself.

Turnaround Strategy

Use Print-on-Demand services like Printful or Printify to offer your own designs on items like mugs, t-shirts, and socks. This keeps you compliant while still using third-party fulfillment.

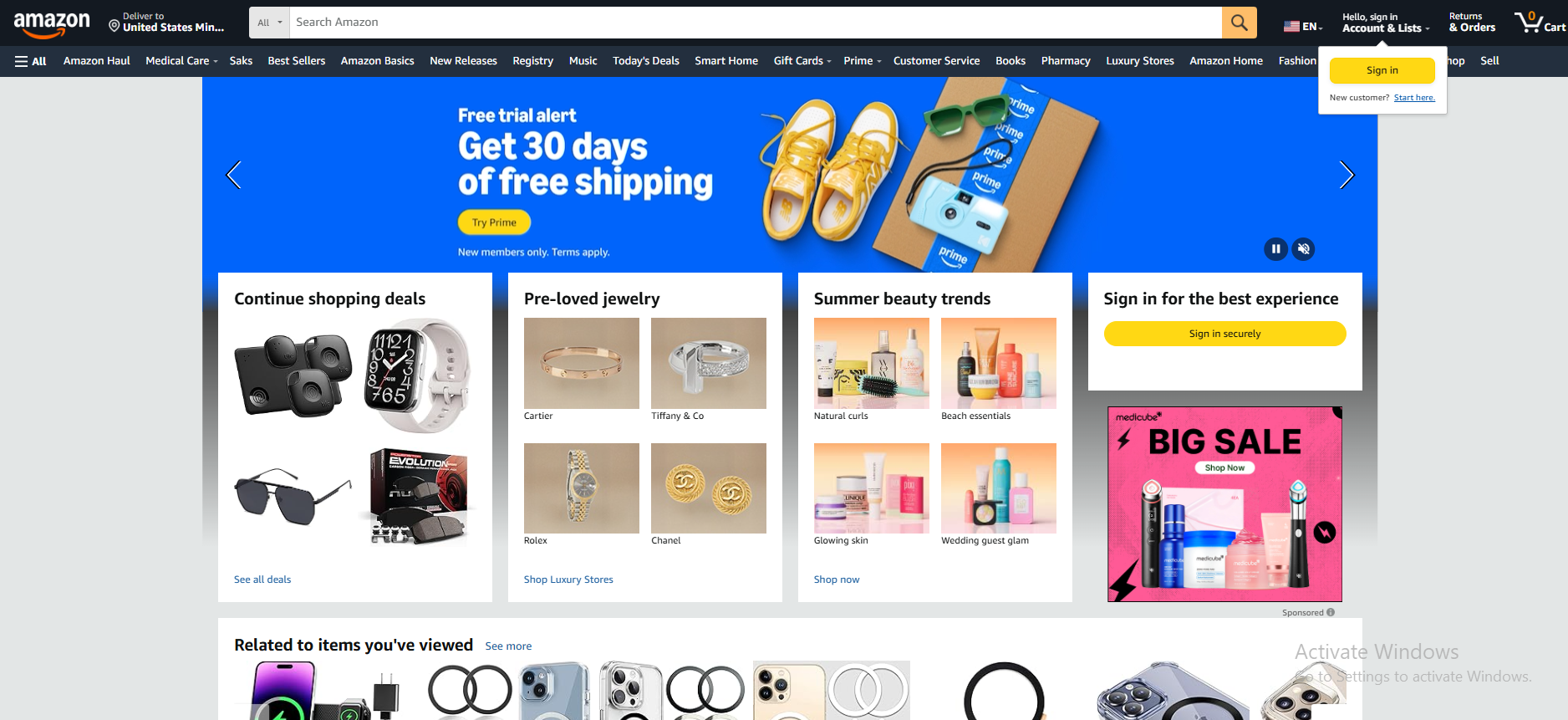

Amazon

Is Dropshipping Allowed?

Yes – with restrictions

Platform Policy

Amazon allows dropshipping if you follow strict guidelines. You must:

- Be the seller of record

- Handle customer service and returns

- Avoid third-party branding or invoices in packages

Turnaround Strategy

Work with suppliers that provide neutral packaging or use Amazon FBA. This ensures fast delivery and compliance with Amazon’s policies.

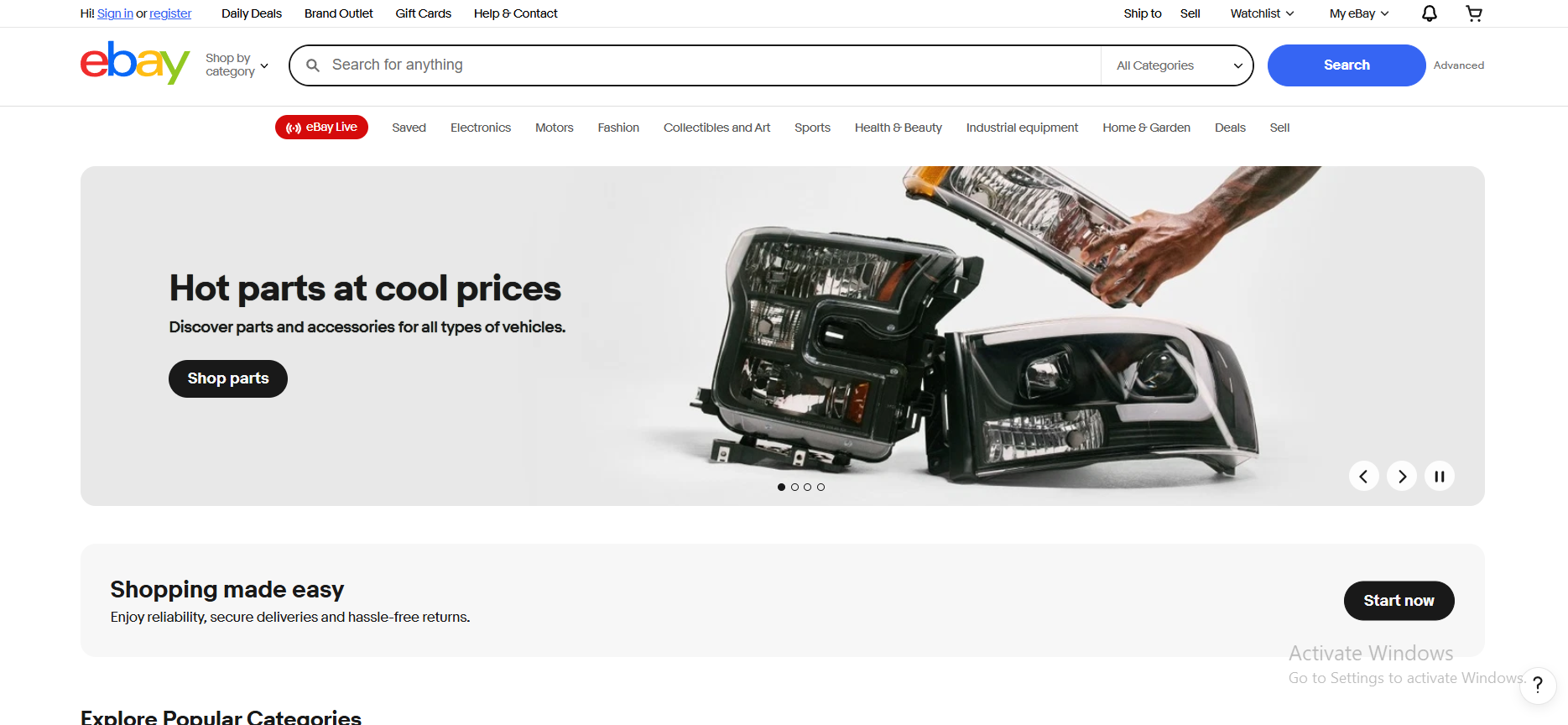

eBay

Is Dropshipping Allowed?

Yes – under specific conditions

Platform Policy

eBay permits dropshipping if you source from a wholesale supplier. Retail arbitrage — like buying from Walmart or Amazon and reselling — is against eBay policy and could result in account suspension.

Turnaround Strategy

Partner with wholesale-friendly platforms like CJ Dropshipping or Spocket. These suppliers are designed for dropshipping and often integrate with automation tools.

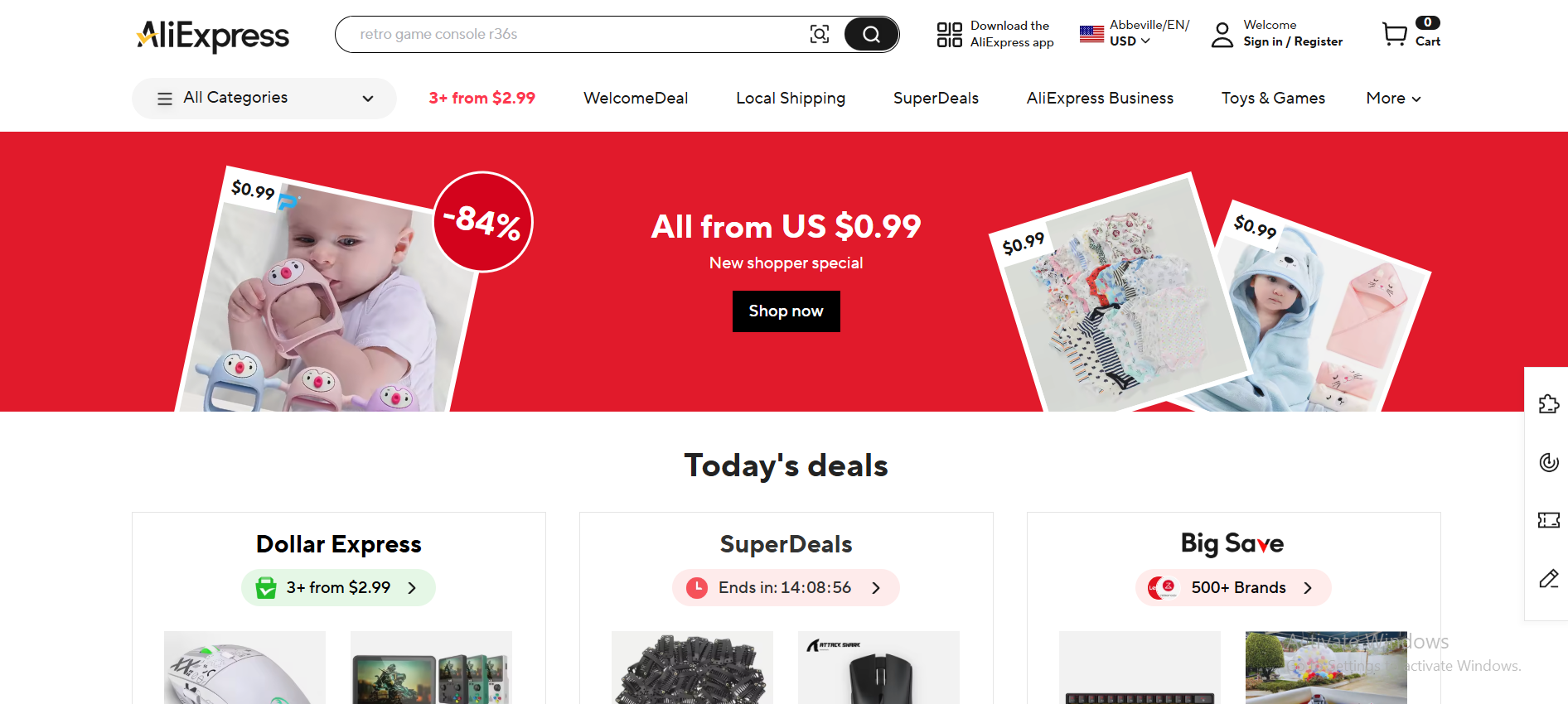

AliExpress

Is Dropshipping Allowed?

Yes – fully allowed

Platform Policy

AliExpress is one of the most popular platforms used for dropshipping. It supports the model, provides buyer protection, and has a wide range of low-cost items ideal for reselling.

Turnaround Strategy

Use tools like DSers or AutoDS to automate the product import and order fulfillment process. Make sure to work with top-rated suppliers and those offering faster shipping methods like ePacket or AliExpress Standard.

Temu

Is Dropshipping Allowed?

No – not allowed

Platform Policy

Temu is strictly for personal use and does not allow commercial reselling or business use of their products. Their terms clearly prohibit using the platform for dropshipping.

Turnaround Strategy

Use Temu for product research only. If you spot a trending product, find a similar version on Alibaba or 1688, then work with a supplier who offers bulk pricing and dropshipping services.

Shopify

Is Dropshipping Allowed?

Yes – fully allowed

Platform Policy

Shopify gives you complete freedom to build your own store, so dropshipping is absolutely allowed. You manage your own fulfillment, products, and marketing strategies.

How To Dropship?

Use apps like Zendrop, Spocket, or DSers to import products, automate pricing, and streamline fulfillment. This is one of the best options if you want full control over your brand and customer experience.

Walmart Marketplace

Is Dropshipping Allowed?

Yes – with strict guidelines

Platform Policy

Walmart allows dropshipping if you:

- Are the seller of record

- Ship products without third-party logos or branding

- Do not source from other retailers (like Amazon or Target)

Turnaround Strategy

Use Walmart Fulfillment Services (WFS) or connect with certified wholesale suppliers like GreenDropShip or Salehoo. These options allow you to stay compliant while reaching Walmart’s massive customer base.

Target

Is Dropshipping Allowed?

No – not allowed

Platform Policy

Target is for personal retail purchases only. Using it to source products for reselling or dropshipping violates its terms of service.

Turnaround Strategy

Use Target to analyze trending products. Once you identify a hot item, find a similar one on Alibaba, AliExpress, or through verified dropshipping suppliers that allow resale.

What Is Illegal in Dropshipping?

Here are a few dropshipping practices that you should avoid at all costs.

💡 Tip: Learn about LLC vs LLP: What’s The Big Difference?

❌ Selling Unauthorized Products

The biggest mistake you can make while dropshipping is to sell unauthorized products. This is 100% illegal.

You need to initially get authorization from the supplier that possesses these products, and then, it is considered legal.

Here is an example of unauthorized selling:

You find car parts from a brand that sells them. You decide to sell these car parts in your dropshipping store, without finding a supplier to fulfill these orders. This is 100% illegal.

There are countless dropshipping businesses that do this. However, if you don’t have an agreement or build a partnership with suppliers or a brand, your dropshipping business will be down faster than you think.

Not only that but you may also get sued and have to pay very high fees.

It is not that difficult to become an authorized seller, all you have to do is to contact suppliers and ask them what they need from you for authorization.

❌ Avoiding Taxes

You can avoid anything, but not taxes. Just like any other business, dropshipping requires you to pay taxes. So, if want to ensure your dropshipping business is legal, you must pay attention to this.

Taxes all depend on the amount of profit you make, so always consider writing down or calculating what revenue you will earn and how much will go to taxes.

Each state has a different tax law. Taxes might also change from year to year, so always be sure to contact an attorney who specializes in e-commerce tax law.

👉 Read about Dropshipping Taxes and Payments – Guide For Beginners.

❌ Mis-Information

Failing to represent an item can be a complete failure for your dropshipping business. Misinformation can include anything from selling fake products to selling an item with a different description.

Selling fake products without a doubt is 100% illegal. However, even misrepresenting or misinforming about an item can lead to you getting sued.

It can result in you paying fines and closing down your dropshipping business.

Examples of misinformation:

Fake product – You sell a fake Gucci belt or bag. Instead of it being more expensive, you lie to your customers that it is cheaper but the product is actually fake. There are cases where some dropshippers will charge the same price a Gucci belt would cost but the product is actually fake.

Misinformation – You sell a laptop but include specifications that the laptop doesn’t possess. This is an example of misinformation.

How To Prove Your Dropshipping Business is Legal and Legitimate?

If you want your dropshipping business to be legitimate and completely legal, here are a few tips we recommend:

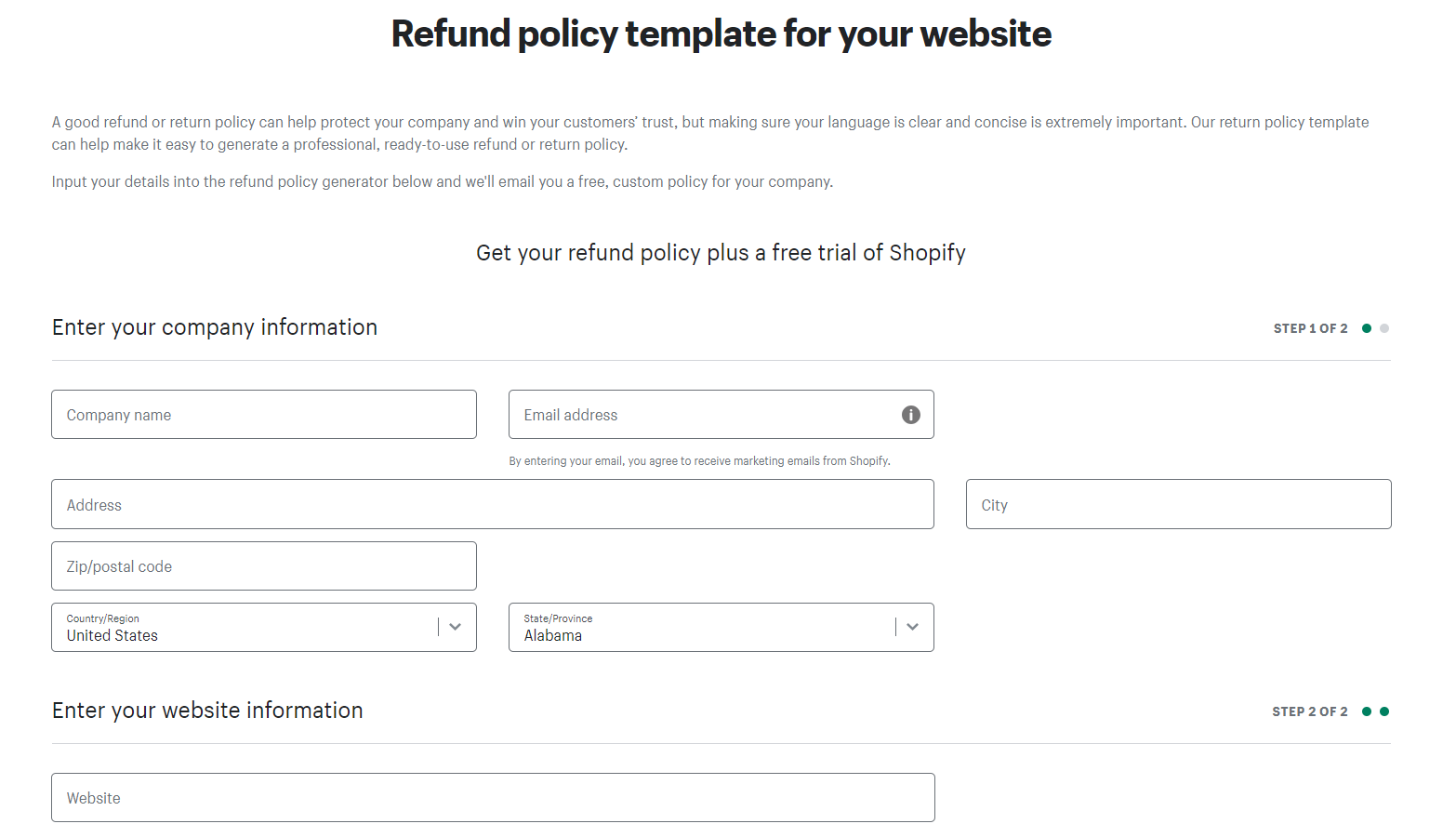

🔸 Refund Policy

In case your product is defective, a refund policy is not mandatory by law. Although, it is good to have one because it increases customer trust.

You don’t need to worry about creating one from scratch, there are many refund policy generators. Shopify has a great well-written refund policy, which you can get here.

🔸 Legal Agreements

Or in other words, terms & conditions are legal documents that state the responsibilities and rights of your dropshipping business.

Even though just like a refund policy, it isn’t mandatory, it is good to have it. It may help you in case you face any legal issues.

You can generate a legal agreement policy by Shopify.

🔸 Privacy Policy

Another legal document shows you how a business uses your personal information and protects it. Every website that collects personal information from its online visitors should have a privacy policy.

You can generate one here.

How Profitable Is Dropshipping in 2025?

Dropshipping without a doubt is still profitable in 2025. The rise of online purchases around the world keeps increasing year by year. So, based on dropshipping statistics, dropshipping is expected to develop further, reaching $464.4 billion in 2025.

💡 Tip: Learn about Dropship Baby Products: A Step-By-Step Guide + Top 24 Products

Dropshipping in Specific Countries in 2025

Is Dropshipping Legal in the USA?

✅ Yes, dropshipping is legal in the United States and continues to thrive. The U.S. remains one of the most profitable markets for dropshippers.

Update for 2025:

- PayPal does support dropshipping, but it now has stricter seller policies. If your fulfillment times are slow or customers file too many disputes, PayPal may temporarily limit your account.

- To reduce risk: Always use verified suppliers, provide tracking numbers, and ship within the expected timeframe.

- Alternatives like Stripe, Shopify Payments, and Square are widely used and recommended.

Is Dropshipping Legal in Canada?

✅ Yes, completely legal. The Canadian government hasn’t placed restrictions on the dropshipping model.

2025 update:

- Canada still emphasizes accurate customs declarations and HST/GST tax compliance.

- If you’re shipping into Canada from outside, be sure your customer is aware of any import duties that may apply.

- Digital Service Tax (DST) is being reviewed in 2025 for foreign sellers—watch for updates if you’re outside Canada but sell to Canadian customers.

Is Dropshipping Legal in Germany?

✅ Yes, dropshipping is legal in Germany and subject to strict VAT and e-commerce laws.

Important 2025 update:

- You must register for VAT in Germany if you’re selling to German customers from outside the EU and surpass the €10,000 OSS (One-Stop-Shop) threshold.

- Product compliance (especially electronics, toys, and cosmetics) is heavily enforced. Make sure your items meet CE certification, WEEE rules, and German packaging laws.

- EPR (Extended Producer Responsibility) and LUCID registration are required for packaging sent into Germany.

Is Dropshipping Legal in the UK?

✅ Yes, it’s legal. The UK remains a solid market post-Brexit.

2025 update:

- Non-UK sellers must register for UK VAT if storing goods there or selling over the VAT threshold.

- Consumer rights laws, return policies, and data protection under UK GDPR apply to all online stores.

- Note: UK customs charges apply to goods over £135. The VAT is collected at the point of sale for these.

Check our ultimate list of 20+ Dropshipping Suppliers In the UK.

Is Dropshipping Legal in Australia?

✅ Yes, Australia fully allows dropshipping.

2025 update:

- The GST threshold is $0 – meaning you must collect GST on all goods sold to Australian consumers, even if you’re outside Australia.

- You should register for an ABN (Australian Business Number) and GST if you exceed AUD $75,000 in annual turnover.

- The Australian Consumer Law still enforces refund rights and transparent communication of delivery terms.

Is Dropshipping Legal in Spain?

✅ Yes, legal and subject to EU regulations.

2025 update:

- Spain follows the EU OSS VAT rules. You must register for VAT or use OSS if you’re in the EU, or a local VAT number if you’re outside.

- The statement “EU VAT is 19%” is incorrect: Spain’s VAT is 21%. France is 20%, and other EU countries vary (not uniform).

- As always, avoid counterfeit goods and clearly state return, delivery, and tax terms.

Conclusion

These were our answers to see if dropshipping is legal or not. We covered what is mandatory to have, and what isn’t.

What makes your dropshipping business more legitimate, and if dropshipping is legal in the specific countries we mentioned.

If you are concerned about starting a dropshipping business in a specific country, you can visit our “Start Dropshipping In” section on our website, and read all articles that show you how to start a dropshipping business in different countries.

![The Top 21 3PL Companies Compared [2025 List & Guide]](https://images.weserv.nl/?url=https://prod-dropshipping-s3.s3.fr-par.scw.cloud/2024/03/Frame-3922469.jpg&w=420&q=90&output=webp)